Have you ever heard of a digital dollar? Tether (USDT) is just that! It’s a special kind of digital money that acts a lot like a regular US dollar. Unlike other digital coins whose value can go up and down quickly, Tether’s value stays pretty much the same.

This makes Tether a great choice for people who want to use digital money without worrying about losing money if prices change. It’s like having a steady ship in a sometimes stormy sea!

In this guide, we’ll explain what Tether is, how it works, and why it might be perfect for you, especially if you’re new to digital money. Let’s get started!

What is Tether USDT?

Imagine a special coin that lives in the world of cryptocurrencies, but it’s different because it stays the same price as the US dollar. That coin is called Tether (USDT)! Tether is a type of cryptocurrency known as a stablecoin. Stablecoins are made to be less wobbly in price compared to other cryptocurrencies like Bitcoin or Ethereum. Here’s a cool thing to know: Tether is actually the most popular stablecoin in the world!

Stable Value: Unlike Bitcoin or Ethereum, USDT keeps its value steady, making it less risky

Easier Transactions: With Tether, you can move money quickly and cheaply across the world

How Does Tether Work?

Tether works by being pegged to real-world currency. This means that for every USDT, there’s a corresponding US dollar held in reserve. This backing is what keeps Tether’s value stable. The company behind Tether claims that you can always trade one USDT for one US dollar. This makes it a popular choice for people who want to use cryptocurrency but don’t want to deal with the volatility of other coins.

Pegged to the Dollar: Tether is linked to the US dollar, providing a stable value

Backed by Reserves: The company holds real dollars to match the amount of Tether in circulation

Comparing Tether to Other Stablecoins

There are other stablecoins similar to Tether, such as USD Coin (USDC) and Binance USD (BUSD). Let’s look at how Tether compares to these alternatives

USD Coin (USDC)

USD Coin, or USDC, is another popular stablecoin. Like Tether, it’s tied to the US dollar, so its value stays stable. However, one big difference is transparency. The company behind USDC is very open about their reserves, meaning they clearly show that each USDC is backed by a real dollar. This makes some people feel more confident using USDC

Binance USD (BUSD)

Binance USD, or BUSD, is another option in the stablecoin world. It’s also pegged to the US dollar and is managed by the popular cryptocurrency exchange Binance. BUSD is known for being reliable and easy to use, especially if you’re trading on Binance’s platform. It offers similar benefits to Tether, like stability and ease of transfer

Why Choose Tether?

Now that we’ve compared Tether USDT to other stablecoins, you might wonder why people choose Tether. One big reason is its popularity. Tether has been around longer than many other stablecoins, so it’s widely accepted and easy to find on most cryptocurrency exchanges. This makes it convenient for trading and transferring money.

Wide Acceptance: Tether is available on almost all cryptocurrency exchanges.

Convenience: It’s easy to use for buying, selling, and transferring

The Importance of Stablecoins

Stablecoins like Tether play a crucial role in the world of cryptocurrency. They provide a safe place for people to store their money without worrying about big price changes. This makes them useful for everyday transactions, trading, and as a stepping stone for those new to cryptocurrency

Stablecoins offer a stable value, making them less risky.

They’re easy to use, making them a great starting point for beginners

The Future of Tether USDT

The future of Tether is uncertain. Some people believe that Tether will continue to be a popular choice for people who want to use cryptocurrency for payments. Others are concerned about the lack of transparency surrounding Tether. Only time will tell what the future holds for this interesting cryptocurrency.

Important Notes

It’s important to remember that cryptocurrency is a relatively new and risky investment. You should never invest more money than you can afford to lose.

Do your own research before you invest in any cryptocurrency, including Tether

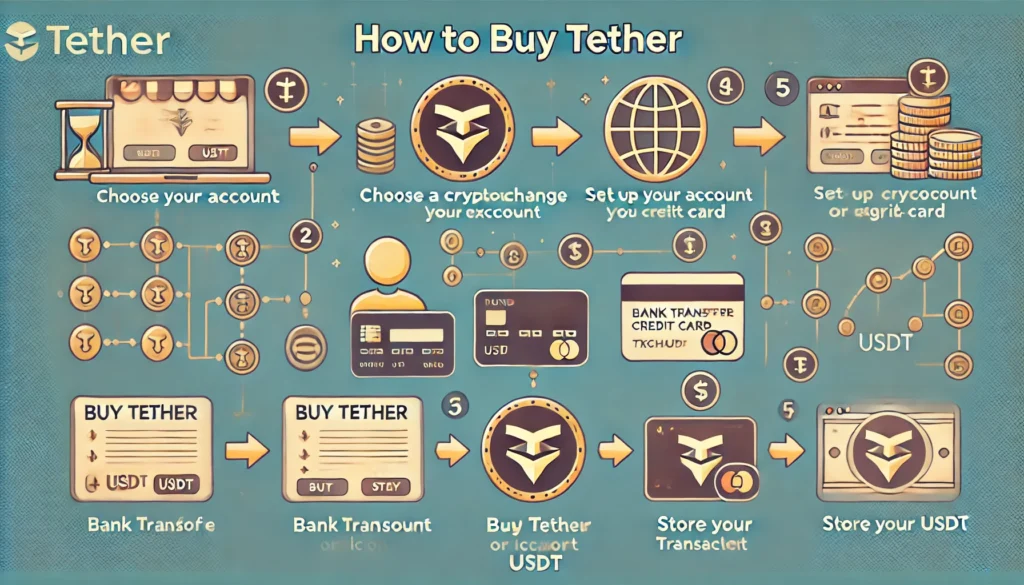

How to Buy Tether (USDT)

If you’re interested in buying Tether, you can do it on a cryptocurrency exchange. Here’s a simplified breakdown of the steps involved

Choose a Cryptocurrency Exchange

There are many different cryptocurrency exchanges to choose from. Make sure you pick one that is reputable and that allows you to buy Tether.

Choose a Cryptocurrency Exchange

There are many different cryptocurrency exchanges to choose from. Make sure you pick one that is reputable and that allows you to buy Tether.

Fund Your Account

Once your account is set up, you’ll need to deposit money into it. You can usually do this with a bank transfer or credit card

Buy Tether

Once you have money in your account, you can then use it to buy Tether

Tether USDT Pros and Cons

Pros

Cons

FAQs

The Final Words Tether USDT is a fascinating idea, but it’s important to understand the risks before you invest. If you’re looking for a way to avoid the wild swings of regular cryptocurrency prices, Tether might be a good option. But just remember, there’s always a chance that the piggy bank story might not be entirely true.